Jushi Holdings Reports $257.5 Million in 2024 Revenue | Where to order Skittles Moonrock online

Learn how to buy weed online. TOP QUALITY GRADE A++

Cannabyss Inc. is the best place online to buy top quality weed, cannabis, vape, marijuana and CBD products. Get your borderless orders delivered at the pickup spot with ease. Top Grade products for client satisfaction.

👉 Click here to Visit our shop! 🛒

[PRESS RELEASE] – BOCA RATON, Fla., March 6, 2025 – Jushi Holdings Inc., a vertically integrated, multistate cannabis operator, announced its financial results for the fourth quarter and full year ended Dec. 31, 2024. All financial information is provided in U.S. dollars unless otherwise indicated and is prepared under U.S. generally accepted accounting principles (GAAP).

Financial Highlights

Q4 2024

- Total revenue of $65.9 million

- Gross profit and gross profit margin of $25.4 million and 38.6%, respectively,

- Net loss of $12.5 million

- Adjusted EBITDA1 and Adjusted EBITDA1 margin of $8 million and 12.2%, respectively

- Cash, cash equivalents and restricted cash were $21.3 million as of the quarter end

- Net cash flows provided by operations of $7.2 million

FY 2024

- Total revenue of $257.5 million

- Gross profit and gross profit margin of $118.3 million and 45.9%, respectively

- Net loss of $48.8 million

- Adjusted EBITDA1 and Adjusted EBITDA1 margin of $46.2 million and 17.9%, respectively

- Net cash flows provided by operations of $21.6 million

1 See “Use of Non-GAAP Financial Information” and “Unaudited Reconciliation of Net Income (Loss) to Adjusted EBITDA and Calculation of Adjusted EBITDA Margin” below.

Fourth Quarter 2024 Company Highlights

- Achieved strong Jushi-branded product sales representing approximately 55% of total retail revenue in Q4 2024 across the company’s five vertical markets.

- Advanced the company’s retail-first expansion strategy by entering into management service agreements with two operating dispensaries in Oxford and Toledo, Ohio, and two provisionally licensed dispensaries sited in Warren and Mansfield, Ohio, and opened our fifth Illinois Beyond Hello dispensary in Peoria.

- Introduced 415 unique SKUs throughout the company’s five vertical markets across a variety of formats, including flower, pre-rolls, edibles, and concentrates.

- Launched a new edibles brand, “Uncommon Kind,” in Massachusetts, Pennsylvania, and Virginia. The new offering features high-quality chews crafted with RSO, live resin, or live rosin concentrates.

Post Quarter-End Developments

- Debuted the company’s latest premium flower brand, “Flower Foundry,” in Virginia. Since its launch in mid-February, the brand has quickly secured its position as the top-selling Jushi-branded SKU in the state.

- Strengthened the balance sheet through the factoring of approximately $6 million of employee retention credit (ERC) claims for approximately $5.1 million in net cash proceeds. The company is also entitled to receive a portion of any interest paid on the respective ERC claims.

- On Feb. 21, 2025, following receipt of regulatory approvals, closed on the acquisition of the two operating dispensaries in Oxford and Toledo, Ohio, that previously had been operated under the management services agreements.

- On Feb. 22, 2025, opened a new Beyond Hello location in Warren, Ohio, marking the fourth operating Beyond Hello dispensary in the state that we are operating under a management service agreement.

- On Feb. 25, 2025, issued 12% second lien notes due in 2026 in the principal amount of approximately $5.1 million, from which the company received net cash proceeds of $4.6 million.

- On Feb. 25, 2025, opened a relocated dispensary in Linwood, Pa., marking the company’s 18th Beyond Hello dispensary in the state.

Management Commentary

“I am pleased with the progress we made in 2024 to strengthen our platform, particularly in reducing debt, enhancing our balance sheet, and improving cash flows from operations—efforts that we believe have positioned us well for our next phase of growth,” Jushi founder, Chairman and CEO Jim Cacioppo said. “As we moved into the second half of 2024, our focus transitioned from debt reduction and capital optimization to driving growth and advancing our retail-first growth strategy through the expansion of our flagship retail banner, Beyond Hello, which has established a strong reputation across our footprint.

“Looking ahead to 2025, we remain committed to building upon this momentum by expanding our retail network across our core footprint with our 7 and 7 initiative, which is our plan to expand our retail presence by 40% by mid-2026 starting with the opening of seven new dispensaries by mid-2025. With five new dispensaries open since the end of Q3 2024 and three more planned before the end of the third quarter, we’ve made good progress on the initial phase of our 7 and 7 initiative and intend to focus the next phase on opportunities in Illinois and Pennsylvania and high-growth markets such as New Jersey and Ohio. We believe this expansion is poised to drive both revenue and profitability while enhancing operational efficiency and margin expansion. On top of that, we believe our continuous product innovations, highlighted by the recent successful launch of the Flower Foundry brand in Virginia, position us to provide even greater value to our customers and patients, setting the foundation for long-term success.”

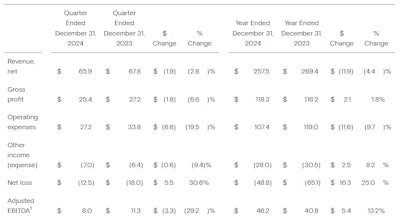

Financial Results for Q4 2024 and FY 2024 ($ in millions)

Revenue for Q4 2024 decreased by $1.9 million as compared to the fourth quarter of 2023. For FY 2024, revenue decreased by $11.9 million as compared to the year 2023.

Retail revenue for Q4 2024 decreased by $0.8 million as compared to Q4 2023, and for FY 2024 decreased $11.4 million as compared to FY 2023. Retail revenue decreased in all states except Virginia and Ohio due to increased competition and market price compression.

In Virginia, retail revenue for Q4 2024 increased $1.9 million as compared to Q4 2023, and increased $7.2 million in FY 2024 as compared to FY 2023. This growth was driven by strong overall performance across all locations, with newer stores continuing to ramp up.

In Ohio, retail revenue in Q4 2024 increased $2.4 million as compared to Q4 2023 and increased $3.5 million in FY 2024 as compared to FY 2023 due to: (i) the transition to adult-use during Q3 2024; and (ii) the addition of two co-located medical and adult-use dispensaries that were consolidated beginning in Q4 2024 as a result of the company entering into management service agreements with two operating dispensaries in Oxford and Toledo, Ohio. Including these two co-located medical and adult-use dispensaries in Ohio, we ended Q4 2024 with 38 operating dispensaries in seven states, as compared to 34 in seven states at the end of Q4 2023.

Wholesale revenue for Q4 2024 decreased by $1.1 million as compared to Q4 2023, and for FY 2024 decreased by $0.5 million as compared to FY 2023. The decrease is primarily due to decreases in Massachusetts and Pennsylvania because of continued competition and limited availability of products available to third parties due to production challenges, resulting in us prioritizing supplying our retail stores. These decreases were partially offset by wholesale revenue growth in Virginia of $0.6 million for Q4 2024 as compared to Q4 2023, and $4.3 million for FY 2024 as compared to FY 2023, as the cultivation and processing facility in Virginia matured and had more product available for sale to third-parties.

Gross profit margin decreased to 38.6% for Q4 2024 as compared to 40.2% for Q4 2023, primarily due to production challenges in our wholesale channel during Q4 2024. For FY 2024, gross profit margin increased to 45.9% as compared to 43.1% for FY 2023, driven by operating efficiencies at our cultivation and processing facilities, which enabled us to reduce cost, partially offset by additional expenses in Ohio, including inventory write downs, as we ramp up our facilities in Ohio to support the transition to adult-use.

Jushi branded product sales across the company’s five vertical markets as a percentage of total retail revenue improved to 55% in Q4 2024 compared to 53% in Q4 2023, and improved to 55% for FY 2024 as compared to 50% for FY 2023.

Operating expenses for Q4 2024 were $27.2 million as compared to $33.8 million in Q4 2023, and for FY 2024 were $107.4 million as compared to $119 million for FY 2023. The quarter-over-quarter and year-over-year decreases were due primarily to: (i) lower asset impairment charges—impairment charges in 2023 primarily relating to goodwill in Nevada which was impaired because of lower-than-expected operating results; and (ii) lower share-based compensation expense which reflects lower value of share-based compensation granted. The decreases were partially offset by higher depreciation and amortization expense primarily due to the amortization of our business licenses which commenced during the second quarter of 2024.

Other expense, net, for Q4 2024 included interest expense of $9.4 million and other expense, net of $1 million, which was partially offset by fair value gain on derivatives of $3.4 million. Other expense, net, for FY 2024 included interest expense of $37.4 million, which was partially offset by fair value gain on derivatives of $6.3 million and other income, net of $3.1 million.

Net loss for Q4 2024 was $12.5 million as compared to $18 million in Q4 2023, and $48.8 million for FY 2024 as compared to $65.1 million FY 2023.

Adjusted EBITDA1 in Q4 2024 was $8 million compared to $11.3 million in Q4 2023, representing a decrease of $3.3 million year-over-year. Adjusted EBITDA1 for FY 2024 was $46.2 million as compared to $40.8 million in FY 2023 representing an improvement of $5.4 million.

1See “Use of Non-GAAP Financial Information” and “Unaudited Reconciliation of Net Income (Loss) to Adjusted EBITDA and Calculation of Adjusted EBITDA Margin” below.

Balance Sheet and Liquidity

As of Dec. 31, 2024, the company had approximately $21.3 million of cash, cash equivalents and restricted cash. For FY 2024, the company paid $4.7 million in capital expenditures. As of Dec. 31, 2024, the company had $3.3 million and $198.2 million in gross principal amount of short-term and long-term debt, respectively, excluding leases and property, plant, and equipment financing obligations. Excluding the $21.5 million related to the promissory notes issued to Sammartino in connection with the acquisition of Natures Remedy, as the company currently has no obligation to repay these notes due to an ongoing dispute, the total debt balance subject to scheduled repayments after the post-quarter end payments was $180 million.

As of Feb. 28, 2025, the company’s issued and outstanding shares were 196,696,597 and its fully diluted shares outstanding were 302,852,551.

Use of Non-GAAP Financial Information

The company believes that the presentation of non-GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to our financial condition and results of operations. For further information regarding these non-GAAP measures, including the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, please refer to the “Unaudited Reconciliation of Net Income (Loss) to Adjusted EBITDA and Calculation of Adjusted EBITDA Margin” section in the company’s press release.

Leave a Reply

Want to join the discussion?Feel free to contribute!