MariMed Reports Fourth Quarter and Full Year 2024 Earnings | How to buy Skittles Moonrock online

Learn how to buy weed online. TOP QUALITY GRADE A++

Cannabyss Inc. is the best place online to buy top quality weed, cannabis, vape, marijuana and CBD products. Get your borderless orders delivered at the pickup spot with ease. Top Grade products for client satisfaction.

👉 Click here to Visit our shop! 🛒

[PRESS RELEASE] – NORWOOD, Mass., March 5, 2025 – MariMed Inc., a leading multistate cannabis operator focused on improving lives every day, announced its financial results for the fourth quarter and year ended Dec. 31, 2024.

MariMed CEO Jon Levine said, “We’re pleased to report record revenues and improved adjusted EBITDA for MariMed. I continue to believe we own one of the strongest portfolios of cannabis brands in the industry, which helped us drive annual wholesale revenue growth of 29 percent. Our brands continue to gain market share in all our core markets, with Betty’s Eddies fruit chews currently the top-selling edible in Massachusetts and Maryland.

“Looking ahead to 2025, we have a number of levers to fuel our growth, including: a full year of financial contribution after completing the build-out or expansion of 10 revenue-generating assets over the past two years; continued wholesale gains in Illinois, Missouri, and Maryland; the consolidation of Delaware’s First State Compassion Center into MariMed as the state prepares for adult-use sales; and accretive M&A activity that will support expanded market penetration for our brands in new and existing states.”

MariMed Chief Financial Officer Mario Pinho said, “MariMed continues to maintain one of the strongest balance sheets in the cannabis industry, and we are pleased to report that we successfully achieved our revised 2024 financial guidance for revenue growth and adjusted EBITDA. Looking ahead, we are well-positioned to leverage our brands and talent to drive continued top-line growth and further enhance profitability in 2025. As we navigate the evolving industry landscape, we remain focused on executing our strategy of delivering the best brands to our customers and delivering long-term value to our shareholders.”

Financial Highlights1

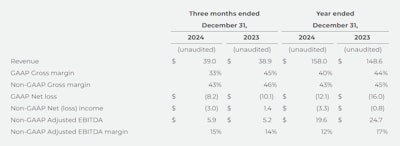

The following table summarizes the company’s consolidated financial highlights (in millions, except percentage amounts):

1 See the reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures and additional information about non-GAAP measures in the section entitled “Discussion of Non-GAAP Financial Measures” below and in the financials information included herewith.

Fourth Quarter 2024 Operational Highlights

During the fourth quarter, the company announced the following developments in the implementation of its strategic growth plan:

- Oct. 14: Commenced growing operations in its new cultivation facility in Mt. Vernon, Ill. The new facility allows the company to grow its award-winning, high-quality Nature’s Heritage flower for distribution throughout the state. The company expects the first harvest to be on shelves this month.

- Oct. 30: Announced the commencement of manufacturing operations in Missouri. The company began wholesale distribution of its branded products throughout the state in late December 2024.

Other Developments

Subsequent to the end of the fourth quarter, the company announced the following development:

- March 3: The state of Delaware approved the company as the owner of First State Compassion Center (FSCC), the state’s leading vertical cannabis operator. Prior to the consolidation of FSCC’s cultivation and processing facilities and two dispensaries into MariMed, the company had been providing management services to FSCC since 2014.

Discussion of non-GAAP Financial Measures

MariMed’s management uses several different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of its business, making operating decisions, and planning and forecasting future periods. The company has provided in this release several non-GAAP financial measures: Non-GAAP Gross margin, Non-GAAP Net income (loss), Non-GAAP Adjusted EBITDA and non-GAAP Adjusted EBITDA margin, as supplements to Revenue, Gross margin, Net (loss) income and other financial measures prepared in accordance with GAAP.

Management believes these non-GAAP financial measures are useful in reviewing and assessing the performance of the company, and when planning and forecasting future periods, as they provide meaningful operating results by excluding the effects of expenses that are not reflective of its operating business performance. In addition, the company’s management uses these non-GAAP financial measures to understand and compare operating results across accounting periods and for financial and operational decision-making. The presentation of these non-GAAP measures is not intended to be considered in isolation or as a substitute for the financial information prepared in accordance with GAAP.

Management believes that investors and analysts benefit from considering non-GAAP financial measures in assessing the company’s financial results and its ongoing business, as it allows for meaningful comparisons and analysis of trends in the business. In particular, non-GAAP adjusted EBITDA is used by many investors and analysts themselves, along with other metrics, to compare financial results across accounting periods and to those of peer companies.

As there are no standardized methods of calculating non-GAAP financial measures, the company’s calculations may differ from those used by analysts, investors and other companies, even those within the cannabis industry, and therefore may not be directly comparable to similarly titled measures used by others.

Management defines non-GAAP Adjusted EBITDA as income from operations, determined in accordance with GAAP, excluding the following items:

- depreciation of fixed assets;

- amortization of acquired intangible assets;

- Impairment or write-downs of intangible assets;

- inventory revaluation;

- stock-based compensation;

- severance;

- legal settlements; and

- acquisition-related and other expenses.

For further information, please refer to the publicly available financial filings available on MariMed’s Investor Relations website, as filed with the U.S. Securities and Exchange Commission, or as filed with the Canadian securities regulatory authorities on the SEDAR website.

Leave a Reply

Want to join the discussion?Feel free to contribute!